How Does Holiday Pay Work With An Umbrella Company . most providers will usually work out umbrella company holiday pay as 12.07% of your gross taxable income. We do not withhold any elements of your net pay. according to government guidance on working for an umbrella company, your holiday pay must be deducted from the assignment rate for your. Your holiday pay will be paid to you in advance of your taking leave. 5.6 ÷ 46.4 = 12.07% Here at parasol, it’s simple. umbrella company employees must consider holiday pay when negotiating a contract. holiday pay is included at the rate agreed upon by the employee and their recruitment agency. How does holiday pay work for umbrella employees? one of the many advantages of working through an umbrella company for contractors is holiday pay. The 5.6 weeks of statutory holiday entitlement is divided by the number of working weeks left over after the 5.6 is deducted. Here’s an example of how holiday pay is calculated: Unlike permanent staff members, the holiday pay.

from mcl.accountants

Here at parasol, it’s simple. Here’s an example of how holiday pay is calculated: one of the many advantages of working through an umbrella company for contractors is holiday pay. according to government guidance on working for an umbrella company, your holiday pay must be deducted from the assignment rate for your. The 5.6 weeks of statutory holiday entitlement is divided by the number of working weeks left over after the 5.6 is deducted. most providers will usually work out umbrella company holiday pay as 12.07% of your gross taxable income. 5.6 ÷ 46.4 = 12.07% We do not withhold any elements of your net pay. umbrella company employees must consider holiday pay when negotiating a contract. Unlike permanent staff members, the holiday pay.

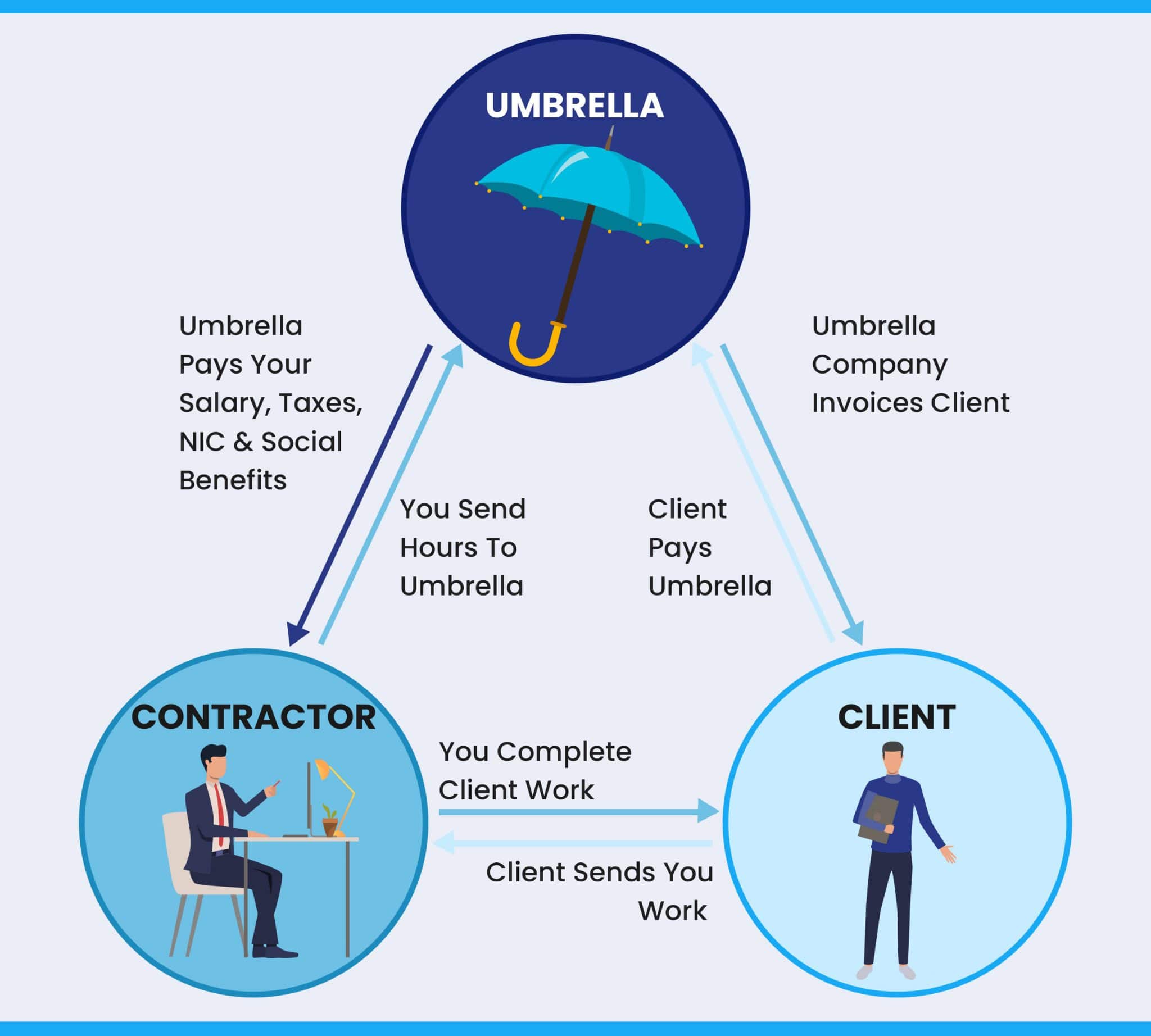

What is an Umbrella Company & How Does It Work?

How Does Holiday Pay Work With An Umbrella Company Unlike permanent staff members, the holiday pay. according to government guidance on working for an umbrella company, your holiday pay must be deducted from the assignment rate for your. Here’s an example of how holiday pay is calculated: We do not withhold any elements of your net pay. Unlike permanent staff members, the holiday pay. most providers will usually work out umbrella company holiday pay as 12.07% of your gross taxable income. one of the many advantages of working through an umbrella company for contractors is holiday pay. Your holiday pay will be paid to you in advance of your taking leave. The 5.6 weeks of statutory holiday entitlement is divided by the number of working weeks left over after the 5.6 is deducted. 5.6 ÷ 46.4 = 12.07% Here at parasol, it’s simple. holiday pay is included at the rate agreed upon by the employee and their recruitment agency. How does holiday pay work for umbrella employees? umbrella company employees must consider holiday pay when negotiating a contract.

From globalpeo.com

What is an Umbrella Company? By GlobalPEO How Does Holiday Pay Work With An Umbrella Company Here at parasol, it’s simple. Here’s an example of how holiday pay is calculated: Your holiday pay will be paid to you in advance of your taking leave. How does holiday pay work for umbrella employees? We do not withhold any elements of your net pay. The 5.6 weeks of statutory holiday entitlement is divided by the number of working. How Does Holiday Pay Work With An Umbrella Company.

From www.churchill-knight.co.uk

How does holiday pay work with an umbrella company? How Does Holiday Pay Work With An Umbrella Company Unlike permanent staff members, the holiday pay. Here’s an example of how holiday pay is calculated: holiday pay is included at the rate agreed upon by the employee and their recruitment agency. How does holiday pay work for umbrella employees? 5.6 ÷ 46.4 = 12.07% one of the many advantages of working through an umbrella company for contractors. How Does Holiday Pay Work With An Umbrella Company.

From www.nogentech.org

Benefits Of Working with An Umbrella Company How Does Holiday Pay Work With An Umbrella Company We do not withhold any elements of your net pay. Here’s an example of how holiday pay is calculated: according to government guidance on working for an umbrella company, your holiday pay must be deducted from the assignment rate for your. How does holiday pay work for umbrella employees? holiday pay is included at the rate agreed upon. How Does Holiday Pay Work With An Umbrella Company.

From www.informdirect.co.uk

What is an umbrella company? Inform Direct How Does Holiday Pay Work With An Umbrella Company most providers will usually work out umbrella company holiday pay as 12.07% of your gross taxable income. The 5.6 weeks of statutory holiday entitlement is divided by the number of working weeks left over after the 5.6 is deducted. How does holiday pay work for umbrella employees? Unlike permanent staff members, the holiday pay. Your holiday pay will be. How Does Holiday Pay Work With An Umbrella Company.

From husp.co.uk

Umbrella company holiday pay Husp Umbrella company holiday pay How Does Holiday Pay Work With An Umbrella Company We do not withhold any elements of your net pay. one of the many advantages of working through an umbrella company for contractors is holiday pay. Your holiday pay will be paid to you in advance of your taking leave. 5.6 ÷ 46.4 = 12.07% holiday pay is included at the rate agreed upon by the employee and. How Does Holiday Pay Work With An Umbrella Company.

From www.epayme.co.uk

Umbrella Company or PAYE? ePayMe How Does Holiday Pay Work With An Umbrella Company one of the many advantages of working through an umbrella company for contractors is holiday pay. Here’s an example of how holiday pay is calculated: holiday pay is included at the rate agreed upon by the employee and their recruitment agency. We do not withhold any elements of your net pay. umbrella company employees must consider holiday. How Does Holiday Pay Work With An Umbrella Company.

From www.sableinternational.com

Everything you need to know about working through an umbrella company How Does Holiday Pay Work With An Umbrella Company most providers will usually work out umbrella company holiday pay as 12.07% of your gross taxable income. Unlike permanent staff members, the holiday pay. according to government guidance on working for an umbrella company, your holiday pay must be deducted from the assignment rate for your. one of the many advantages of working through an umbrella company. How Does Holiday Pay Work With An Umbrella Company.

From novahellaann.blogspot.com

Umbrella payroll calculator NovahEllaAnn How Does Holiday Pay Work With An Umbrella Company We do not withhold any elements of your net pay. holiday pay is included at the rate agreed upon by the employee and their recruitment agency. Unlike permanent staff members, the holiday pay. Your holiday pay will be paid to you in advance of your taking leave. one of the many advantages of working through an umbrella company. How Does Holiday Pay Work With An Umbrella Company.

From www.zippia.com

How Does Holiday Pay Work? (With Examples) Zippia How Does Holiday Pay Work With An Umbrella Company umbrella company employees must consider holiday pay when negotiating a contract. We do not withhold any elements of your net pay. Your holiday pay will be paid to you in advance of your taking leave. holiday pay is included at the rate agreed upon by the employee and their recruitment agency. 5.6 ÷ 46.4 = 12.07% most. How Does Holiday Pay Work With An Umbrella Company.

From truein.com

Holiday Pay Calculator How To Calculate Holiday Pay For Hourly Employees? How Does Holiday Pay Work With An Umbrella Company umbrella company employees must consider holiday pay when negotiating a contract. Your holiday pay will be paid to you in advance of your taking leave. How does holiday pay work for umbrella employees? Unlike permanent staff members, the holiday pay. Here’s an example of how holiday pay is calculated: We do not withhold any elements of your net pay.. How Does Holiday Pay Work With An Umbrella Company.

From umbrellacompanies.org.uk

Umbrella Company Payslip Example Read our indepth guide to payslips How Does Holiday Pay Work With An Umbrella Company according to government guidance on working for an umbrella company, your holiday pay must be deducted from the assignment rate for your. Here at parasol, it’s simple. holiday pay is included at the rate agreed upon by the employee and their recruitment agency. Unlike permanent staff members, the holiday pay. The 5.6 weeks of statutory holiday entitlement is. How Does Holiday Pay Work With An Umbrella Company.

From www.tjwcontracts.co.uk

Understanding holiday pay for contractors How Does Holiday Pay Work With An Umbrella Company umbrella company employees must consider holiday pay when negotiating a contract. The 5.6 weeks of statutory holiday entitlement is divided by the number of working weeks left over after the 5.6 is deducted. How does holiday pay work for umbrella employees? one of the many advantages of working through an umbrella company for contractors is holiday pay. We. How Does Holiday Pay Work With An Umbrella Company.

From umbrellarequirements.co.uk

How does Holiday Pay work with an Umbrella Company? Umbrella Requirements How Does Holiday Pay Work With An Umbrella Company Here’s an example of how holiday pay is calculated: The 5.6 weeks of statutory holiday entitlement is divided by the number of working weeks left over after the 5.6 is deducted. Your holiday pay will be paid to you in advance of your taking leave. one of the many advantages of working through an umbrella company for contractors is. How Does Holiday Pay Work With An Umbrella Company.

From www.coreadviz.co.uk

All You Need to Know about Umbrella Company How Does Holiday Pay Work With An Umbrella Company We do not withhold any elements of your net pay. according to government guidance on working for an umbrella company, your holiday pay must be deducted from the assignment rate for your. Here at parasol, it’s simple. holiday pay is included at the rate agreed upon by the employee and their recruitment agency. Unlike permanent staff members, the. How Does Holiday Pay Work With An Umbrella Company.

From www.umbrellacompanycalculator.co.uk

What is an umbrella company? Read our short explanation How Does Holiday Pay Work With An Umbrella Company The 5.6 weeks of statutory holiday entitlement is divided by the number of working weeks left over after the 5.6 is deducted. according to government guidance on working for an umbrella company, your holiday pay must be deducted from the assignment rate for your. Your holiday pay will be paid to you in advance of your taking leave. . How Does Holiday Pay Work With An Umbrella Company.

From www.fairpayservices.co.uk

Umbrella Contractors Fair Pay Services How Does Holiday Pay Work With An Umbrella Company one of the many advantages of working through an umbrella company for contractors is holiday pay. We do not withhold any elements of your net pay. most providers will usually work out umbrella company holiday pay as 12.07% of your gross taxable income. Unlike permanent staff members, the holiday pay. How does holiday pay work for umbrella employees?. How Does Holiday Pay Work With An Umbrella Company.

From umbrellacompanies.org.uk

Umbrella Company Holiday Pay Everything You Need to Know How Does Holiday Pay Work With An Umbrella Company Here at parasol, it’s simple. Here’s an example of how holiday pay is calculated: according to government guidance on working for an umbrella company, your holiday pay must be deducted from the assignment rate for your. We do not withhold any elements of your net pay. The 5.6 weeks of statutory holiday entitlement is divided by the number of. How Does Holiday Pay Work With An Umbrella Company.

From mcl.accountants

What is an Umbrella Company & How Does It Work? How Does Holiday Pay Work With An Umbrella Company Your holiday pay will be paid to you in advance of your taking leave. 5.6 ÷ 46.4 = 12.07% holiday pay is included at the rate agreed upon by the employee and their recruitment agency. Here at parasol, it’s simple. one of the many advantages of working through an umbrella company for contractors is holiday pay. Unlike permanent. How Does Holiday Pay Work With An Umbrella Company.